At GDS Link, our mission is to empower lenders with robust software, advanced analytics, and advisory consulting to drive growth while effectively managing risk. For nearly two decades, we have been a trusted partner to thousands of lending institutions and diverse organizations worldwide. Our industry-specific credit risk management insights guide the development and implementation of tailored solutions that meet each client’s unique needs.

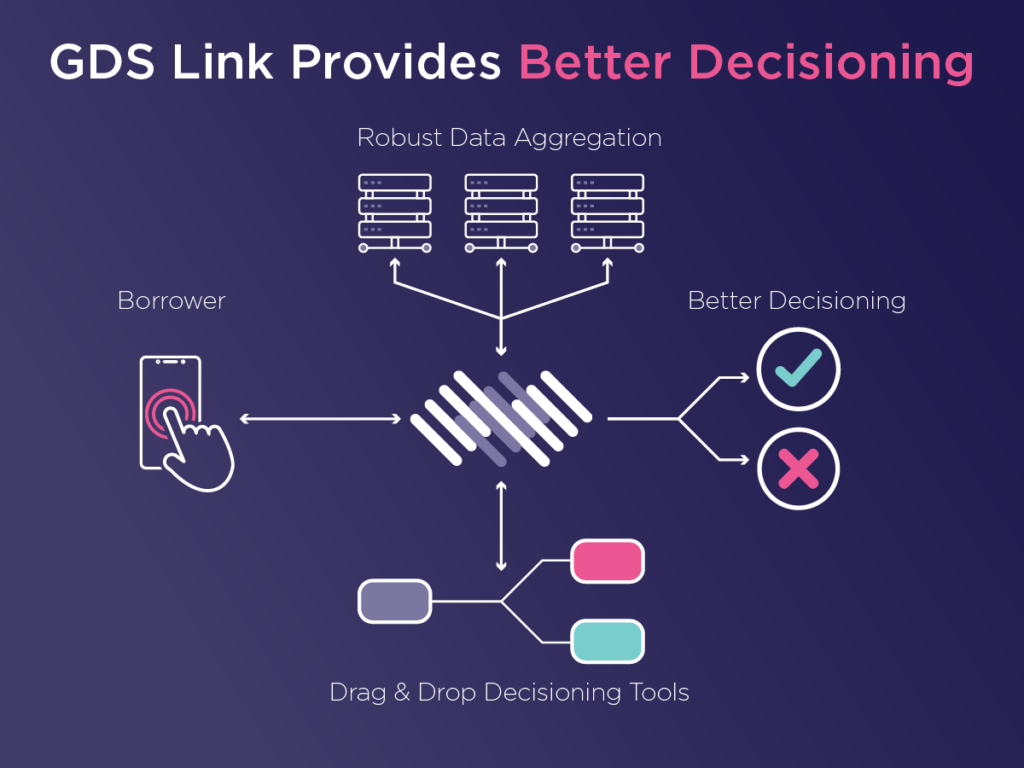

We optimize our clients’ performance, enabling them to focus on increasing revenue and maximizing their existing customer base. Our integrated risk management software and analytics ensure organizations fully leverage available data to elevate their lending capabilities.

With expertise in advanced risk analytics and a deep understanding of the evolving lending landscape, GDS Link delivers solutions and services that address immediate needs, accelerate loan funding, and efficiently manage the borrower lifecycle.