GDS Link has a deep partner ecosystem. With more than 200 sources of data available within our software, we drive innovation to power data, decisioning and analytics. Read on to learn how Powerlytics helps accelerate lending with their True Income solution.

Accurate Income with Zero Customer Friction

The Challenge

When evaluating whether to extend credit, an alternative lender needed an accurate, real time and frictionless way to understand consumer’s ability to pay.

Historically, the lender was forced to choose between two

sub-optimal solutions:

- Obtain tax returns or W2s from prospects – this was time-consuming and expensive and also deterred many creditworthy prospects who did not want to go through the effort of providing documentation early in their application process or providing bank account information to allow a third party to access their payroll information.

- Work with vendors that did not have 100% coverage of verified income and instead relied on inaccurate models to estimate the 50% to 75% of the population that was not covered with accurate income data.

The Solution

Powerlytics worked with the lender to test and implement Powerlytics True Income, a suite of Income Verification and Estimation products that leverage anonymized real income data from over 150M U.S. households and covering over 200M adults.

Based on an individual’s ZIP+4, True Income can:

- Provide a confidence score of 1 to 10 based on the likelihood the consumer stated income is accurate.

- Deliver an income estimate based either on a customer’s total income or income components (e.g., W2 Wages, interest, dividend, capital gains, etc.).

Key differentiators of True Income:

Reviewed for Use by Regulators – True Income is not a modeled solution but is built by using statistical distributions of anonymized tax filings. As a result, the OCC has provided guidance for marketing, underwriting, and proactive credit line increases.

Covers 100% of US Income Tax Filers – Many other solutions are limited to a narrow range of the population.

Covers All Forms of Income – W2, wealth, retirement, business; other solutions may only cover W2.

Zero Customer Friction – The only information needed is the prospect or customer’s ZIP+4; based on this data alone, Powerlytics can deliver a highly accurate income score or estimate.

Real Time – Powerlytics True Income API suite can offer real time income estimates and verification scores. Batch updates can be fulfilled quickly and efficiently as well.

Customized to Meet Your Needs – Powerlytics can further refine income scores and estimates to meet a client’s unique needs. Scores and estimates can be tailored for homeowners vs. renters and further tuned based on the product offered or segment targeted.

Testing and Validation

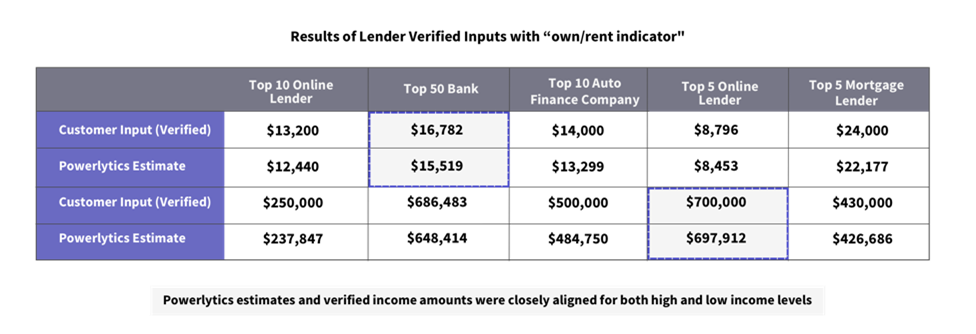

To get the lender comfortable with its income estimates, Powerlytics shared the results of a number of blind tests with banks and lenders where our True Income solution consistently outperformed in-house and third-party income prediction models. This chart shows the results of blind tests with 5 lenders where the lender shared the encryption key to identify which incomes were verified to evaluate results.

Powerlytics estimates were very close to verified customer income at both low and high income levels.

The lender then went through a live pilot to test Powerlytics True Income against its current vendor and manual verification processes. The results showed that Powerlytics True Income solution surpassed their current vendor and manual efforts on accuracy, timeliness and affordability.

The Impact

Following the successful pilot and implementation of Powerlytics True Income, the lender can now approve many applicants without requiring an individual to provide access to their bank account or provide W2s, tax returns or other information.

Driving Innovation In Lending

Through this partnership, GDS Link and Powerlytics drive innovation in lending. GDS Link provides solutions, analytics, and advisory services to to help lenders lend more, profit more, and risk less all while delivering an end-to-end digital loan experience. Learn more about our solutions here or request a demo below to get started.