Ser Technology, a stalwart in the credit union industry providing loan generation marketing services, has been acquired by GDS Link, the nextgen leader in loan decisioning and analytics. The acquisition creates a full lifecycle, next-generation loan procurement, and underwriting solution. The combined Company’s services will help credit unions enhance marketing, decisioning, and lending to support strategic focus on member well-being and compete with the most sophisticated lenders in the marketplace today.

CEO of GDS Link, Paul Greenwood, is excited about the merger, saying “We appreciate Ser Tech’s foundational presence in the credit union industry and know that GDS Link’s access to data, analytics, and decision modeling will work seamlessly with Ser Tech’s loan generations services. We want to work closely with credit unions to evaluate marketing strategy and lending performance to accelerate the achievement of credit union goals and loan growth”.

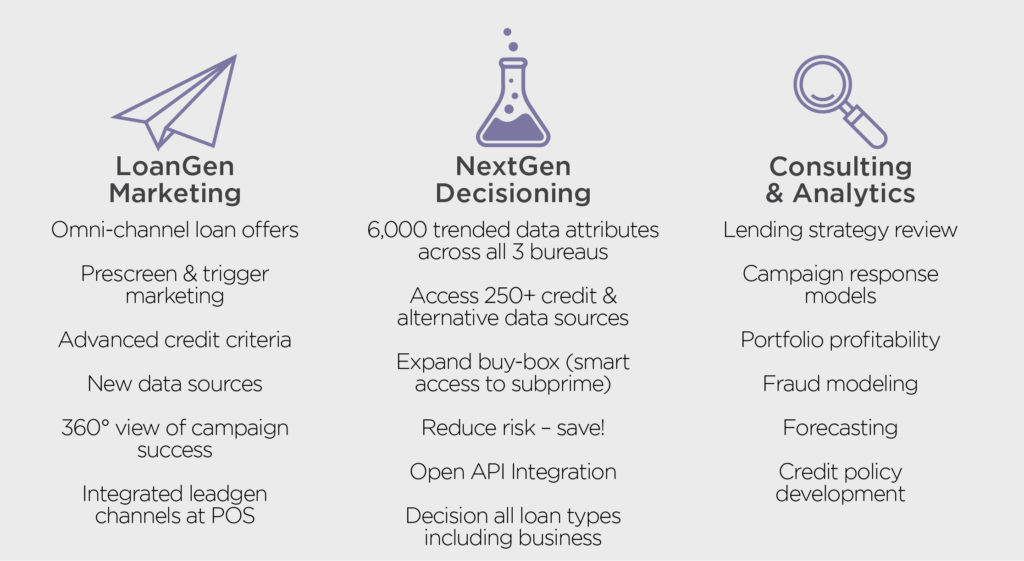

GDS Link brings greater access to data to more precisely target loan opportunities and underwrite all risk levels while achieving better returns than a standard credit score. This data-centric approach allows marketing and lending criteria to be customizable based on client needs.

About Ser Tech

Ser Tech has served the credit union industry for 28 years, working with over 3,000 credit unions in helping its clients secure new loans and refinancing opportunities amounting to over $1 billion annually. Ser Tech has extensive experience developing solutions for loan portfolio growth and has created deep relationships with its clients with a particular focus on service and partnership.

About GDS Link

GDS Link is a global leader in credit data, decisioning, and analytics. By combining powerful artificial intelligence technology with credit and fraud risk management software, data, and decisioning with proven underwriting workflows, GDS Link has the solutions, analytics, and advisory services that drive growth in lending while reducing risk. GDS Link leverages data from over 50 sources to build customizable lending models to expand lending and reduce risk resulting in increased profitability and loss mitigation.