Best credit union marketing campaigns

The last few months have been unprecedented for everyone, but we’re focusing on building toward the future. Helping credit unions add consumers among their memberships because they are the best financial services option for consumers. Adding loans to the books with target marketing efforts and monitoring the risk.

As we charge into the new normal, now is the time to look at how you’re marketing and selling your products. Take the time while your branches are closed or operating at lowered capacity to get your team on the same page. Ensure marketing is working with your sales and service teams to make all the new loans you can to assist members, particularly our most vulnerable ones. You’re using Fetch – of course – to promote all those great new programs you’ve created to help your members. Now what?

Here’s the secret to the credit unions that have found the most success with campaigns, powered by GDS Link Marketing Services: Make the follow-up phone call. A mailer or email will only get you so far, but the contact data our clients receive when a campaign has run is the gift that keeps on giving. ( If you need help with outbound calls, GDS Link Marketing Services can help with that, too! Contact us today to learn more.)

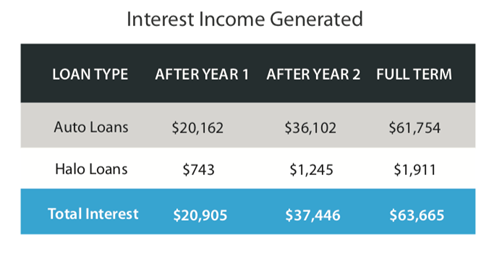

University of Nebraska FCU’s Marketing Campaign for auto loans earned the credit union $7.58 (in just the first year!) for every $1 invested in its campaign, in part because of the credit union’s follow-up calls. If those loans go longer, here’s what the University of Nebraska FCU’s results will look like:

So, to gear your team up to make those calls, here are a few best practices to ensure you get the most from your Marketing Campaigns:

- Be positive when you reach out to your members and potential members. They can hear it on the phone. Confidence, motivation, patience and honesty will pay off.

- Call outside of normal telemarketing hours – lunchtime, evening, late morning. Don’t make the calls when everyone else is. You want to speak with them, not be filtered out with the rest of their sales calls.

- Build rapport. Use their language, and find commonalities when speaking with them. People like doing business with other people, not a machine or someone simply sticking to a script.

- Take notes when you talk to them, especially when you make promises or offer to follow up. Ensure that you stick to your word and share those notes if they talk to one of your colleagues. Members can’t stand repeating themselves or getting conflicting information.

- MANAGERS’ BONUS: Hire personality in this role. It’s so much more important than skills, which can be taught.

Of course, there are always a few don’ts:

- Apologize for calling. There’s a reason for your call, and you’re calling to help your member. That’s no reason to be sorry.

- Be distracted. Turn off other devices and don’t type while they are talking. It sounds as if you aren’t paying attention, and they won’t believe you’re genuine, which will definitely impede your ability to close loans.

- Guess when you don’t know the answer. Take the time to look it up or offer to follow up with an answer. You will lose the member’s trust if you guess and you’re wrong.

- Be unprofessional. Don’t use slang, eat, smoke, or have your cell nearby when making calls. Hopefully, this goes without saying.

There’s plenty of work to get you to the point when you can follow up with consumers to actively engage them and make a loan. GDS Link Marketing Services can help you get there. Our Marketing solutions were designed to target creditworthy consumers to give your credit union the most bang for your marketing budget. Check out how GDS Link can supercharge your marketing to drive leads and sales, and schedule a consultation today.